Let us simplify our “Baskets” for you.

Multiple Basket Options

Rebalancing Opportunities

Invest in MF, Metals, Equity & ETF

Proprietary Ratings

Consistent, Safe & Higher Returns

Multiple Basket Options

Rebalancing Opportunities

Invest in MF, Metals, Equity & ETF

Proprietary Ratings

Consistent, Safe & Higher Returns

The Investments here will focus on increasing the Portfolio size with stable returns over

medium to long term

We will help safeguard your capital to achieve returns that beats inflation. In this persona we

will

focus on minimizing losses and will allow you to make money knowing that the risk of loss is

minimal.

The investments will be a curated list of funds mostly diversified large and multi cap funds ,

very

few small cap. It will also be suitable to have some portion of Equity & ETF Basket investments

and

some portion of Gold/Metal and few other financial investments also.

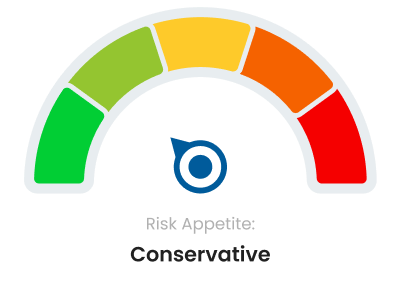

RiskOmeter

Conservative

Riskometer is a graphical representation of the risk of your specific Pension

Plan

and displays 5-levels of risk, each with a respective colour.

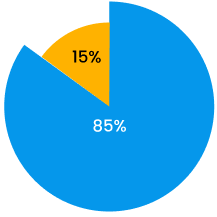

Portfolio Mix of our Pension Investment “Basket”

- Mutual Fund

- Gold

- Equity

This is a very sensible Investment option with an attempt to find relatively higher returns with modest risk over medium to long term.

Intelligent decision for a balanced growth! Investment options in this category will help to grow steadily and achieve your pension goals. As a Moderate investor, the basket will have diversified portfolio of funds with growth opportunities and some level of risk while trying to minimize loss.

The investments will be a curated list of funds mostly diversified large/multi cap & flexi cap funds , proportion of small cap funds will be higher than in conservative pension plans. Equity & ETF Basket investments as a component of Investment will also be more than in Conservative. Their will some portion of Gold/Metal and few other financial investments also.

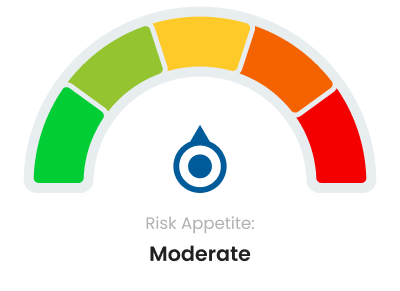

RiskOmeter

Moderate

Riskometer is a graphical representation of the risk of your specific Pension

Plan

and displays 5-levels of risk, each with a respective colour.

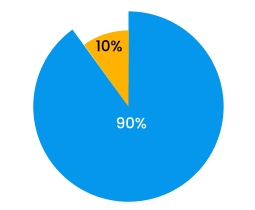

Portfolio Mix of our Pension Investment "Basket"

- Mutual Fund: 90%

- Gold: 10%

You are seeking to maximise returns over medium to long term with comparatively higher risk

The focus is on wealth creation! The aim is to grow wealth for your pension goals. You understand the market dynamics, hence in return for the risks, investors like yourself expect superior returns over the long-term

The investments will be a curated list of funds mostly diversified large/multi cap/flexi/small cap funds. It will also include a good proportion of investments in Equity OR ETF Basket. There will be also a good mix of investments in Gold/Metal and some proportion of other & additional financial investments also.

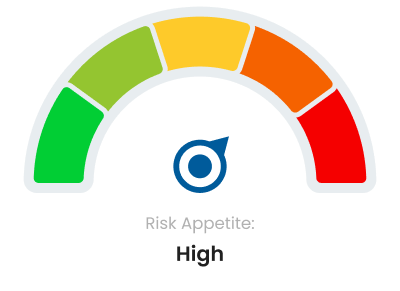

RiskOmeter

High

Riskometer is a graphical representation of the risk of your specific Pension

Plan

and displays 5-levels of risk, each with a respective colour.

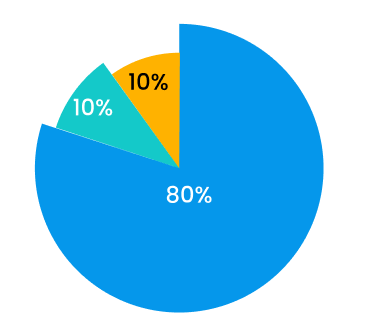

Portfolio Mix of our Pension Investment "Basket"

- Mutual Fund: 80%

- Gold: 10%

- Equity: 10%

Wealth creation with a good Retirement Corpus is the aim. The duration ideally should be long and you have an understanding of the financial instruments being invested and are willing to take some risks to maximise returns

The investment options in this will have baskets with the right Risk-Return Trade-off! Ultra-Aggressive Portfolio has a mix of various Financial Products with a very long term view, giving very high expected returns in comparison to general market returns. The overall objective is to build a sizeable corpus.

The investments will be a curated list of financial instruments including but limited to Mutual Funds/Equity/ETFs/ Gold & Metals and more.

RiskOmeter

Very High

Riskometer is a graphical representation of the risk of your specific Pension

Plan

and displays 5-levels of risk, each with a respective colour.

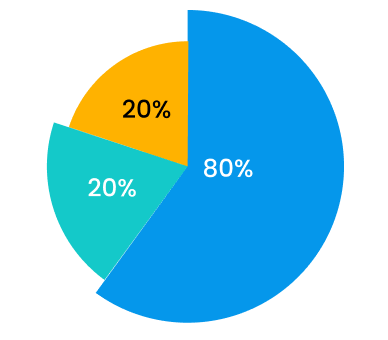

Portfolio Mix of our Pension Investment "Basket"

- Mutual Fund: 80%

- Gold: 20%

- Equity: 20%