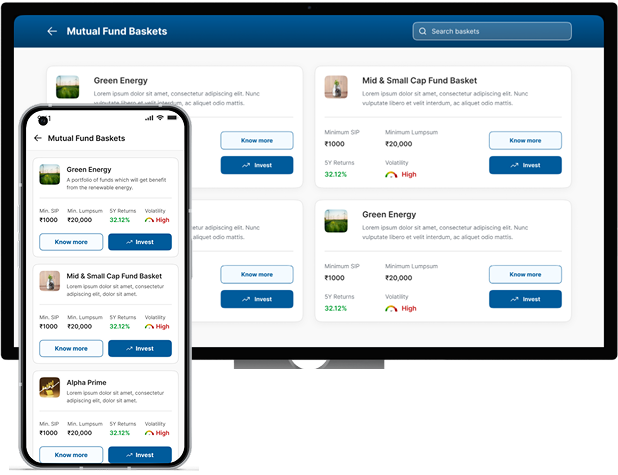

Explore INVULB Mutual Fund Baskets

We utilize Mutual Fund schemes to create curated Baskets based on a specific Strategy or Theme

Invest Now

Mutual Funds are managed by financial experts (called as "Fund Manager"). These funds invest in various financial instruments like Equity (stocks), debt and commodities etc.. These investments are made on various parameters and objectives clearly stated for the specific Fund "scheme".

Start InvestingMutual Funds are low cost and simple to understand

Mutual Funds are regulated by SEBI and other regulatory bodies.

Mutual Funds provide diversification to the customers.

Mutual Funds act effectively as a substitute for direct Equity or market investments

Mutual Funds pool or collect money from Investors and invest/rebalance to provide better returns to its investors for the specific Mutual Fund Scheme.

INVULB has Partnership with only 07 AMCs (Asset management Companies) to distribute their Mutual Fund products

BSE Star MF Platform/AMFI/ Centrum etc.

Officially recognized and authorized by top financial authorities

Fully compliant with financial regulations and industry standards

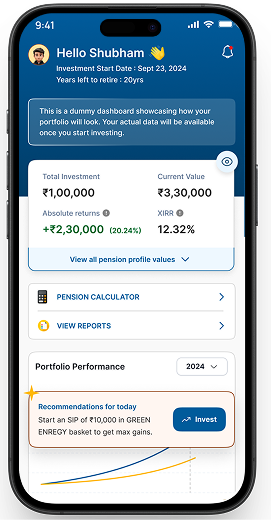

Our primary Goal is to build suitable Retirement Savings for each customer of ours based on the specific requirements of each one of you

You seek safety of capital, for some risk to achieve returns in few years

You seek balanced growth with moderate risk for steady returns over time

You seek higher returns and are comfortable with higher risk for long-term growth

You seek maximum returns and are willing to take significant risk for potential high gains

Answers to the most frequent questions.